Equity generally represents the total sum of money that will be returned to the shareholders of a company in the event that the company’s assets are liquidated and 100% of all business debts are paid in full.

As shareholder equity has a prominent place on the balance sheet of a company, it is also often used by financial analysts to determine the financial health or the book value of a business.

How Does Shareholder Equity Work?

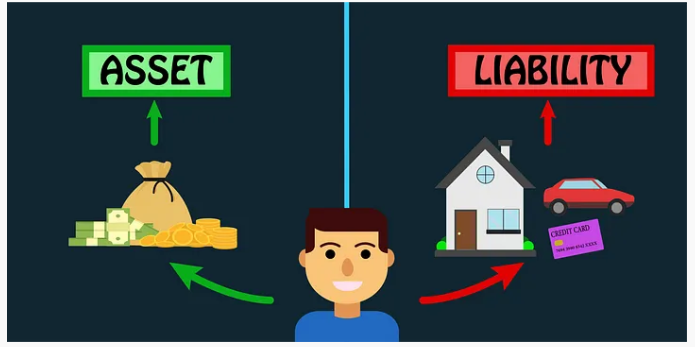

Shareholder equity “assets-liabilities” equation clearly sets out the state of a company’s finances in ways that can be easily understood by analysts and investors alike. Equity is typically used as a way to raise capital, which a company can then use to invest in assets, projects and operations.

Equity represents the actual value of the stake that an investor has in a business, which is showcased via a proportion of shares. Equity provides stakeholders with opportunities to vote in board of directors elections and the potential to receive dividends or capital gains.

What is a transfer of equity solicitor.

Shareholders have the ability to sell or transfer the shares they hold in a company to others. This is a process that a transfer of equity solicitor should support, because it represents a significant financial decision. As this GOV.UK article explains, submitting specific forms is also required as part of the transfer process, so seeking the support and advice of a legal professional is vital.

Is Shareholder Equity Always Positive?

If a company owns enough assets to cover all its liabilities, its shareholder equity will be positive. However, if a company has more liabilities than assets, shareholder equity will be negative. If shareholder equity continues to be negative for a period of time, this is an example of balance sheet insolvency.